Garelick Capital Partners isn’t exactly a household name in the Hedge Fund world. But that may change if the Boston-based hedge fund maintains its torrid performance.

Based on the returns of 13F holdings through Q4’s end, the Boston-based hedge fund is one of the top performers in the WhaleWisdom.com data base. Garelick’s equal-weight WhaleScore is 98 out of 100.

Garlick Capital was established in 2012 by Bruce Garelick. Garelick previously served as an Equity Analyst at Adage Capital Management where he managed a long/short technology portfolio.

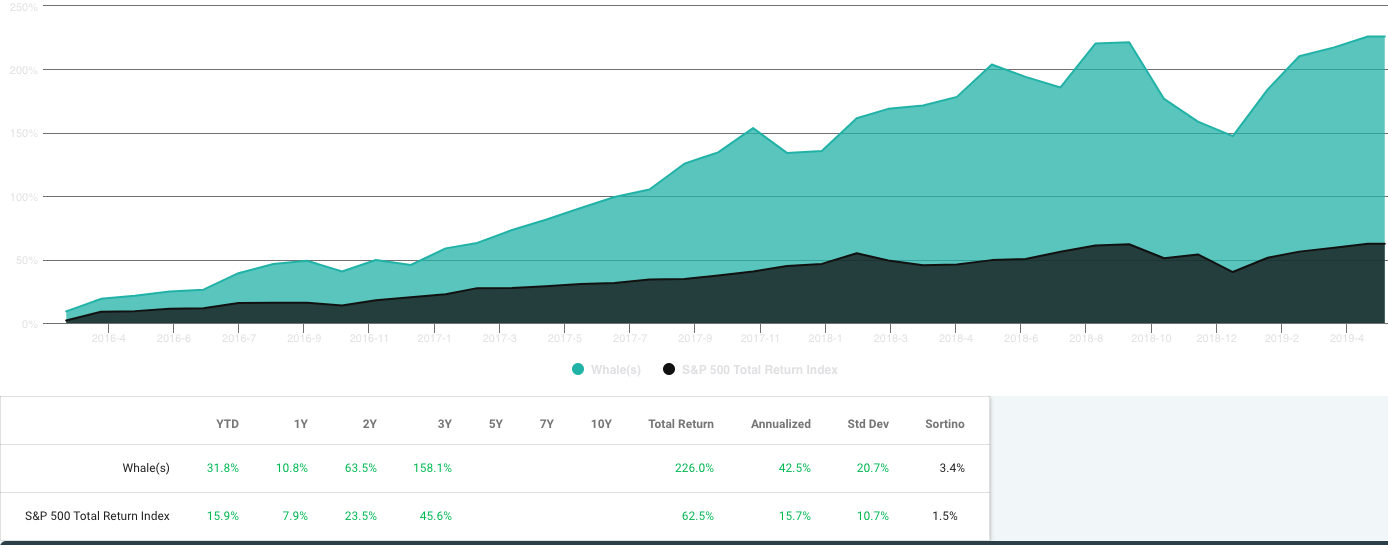

Since the 4th quarter of 2015, when Garelick Capital filed its first 13F, an investor cloning the funds top ten long positions quarterly would have generated a return of 226% — 3.6X the return of the S&P 500. While 2018 was a tough year for most hedge funds, Garelick’s 13F portfolio gained 5.7%.

Here’s how Garelick Capital describes it’s investment strategy in its ADV filed with the SEC:

Garelick Capital employs a fundamental investment approach, coupled with a well‐defined, dynamic risk management framework to control portfolio volatility and common factor risk. Our fundamental approach employs a broad view of the technology sector, with selective deeper focus on particular issuers and/or segments within the sector from time to time, based on themes or opportunities identified by Garelick Capital. In particular, we seek to identify investment opportunities in instances where we believe that our investment process provides us with a superior understanding over consensus views on a targeted investment. Portfolios may invest in a variety of securities and derivative instruments in pursuant of generating positive returns, however the primary focus is expected to be on long and short positions in individual publicly traded equity securities.

Garelick Capital’s top 10 Q4 positions have averaged a 34% return so far in 2019.

Of course, funds do not report short positions and most derivatives in 13F filings. So the above returns do not accurately represent Garelick’s actual fund portfolio. The fund’s AUM at year-end was $831,549,458. Meanwhile 13F securities reported were $359,478,000. So over half of Garelick’s AUM was apparently in assets other than long equities.

In any case, the fund’s long stock selection has been impressive.

And based on Garelick Capital’s positions at year end, the big performance has continued into 2019. The fund’s top 10 largest 13F holdings are up an average of about 34% year-to-date. The fund’s two largest positions at Q4’s close were Ringcentral Inc. (RNG) and Keysight Technology (KEYS). Since year end, those two stocks are up 25.29% and 45.97% respectively.

| Stock | Symbol | 2019 YTD % Gain | Shares Held | % of Portfolio | Previous % of Portfolio | Ranking | Change in shares | Qtr first owned |

| Ringcentral inc | RNG | 25.29% | 320,537 | 7.3509% | n/a | 1 | 320,537 | Q4 2016 |

| Keysight technologies inc | KEYS | 45.97% | 299,655 | 5.175% | n/a | 2 | 299,655 | Q4 2018 |

| Splunk inc | SPLK | 27.73% | 169,975 | 4.9577% | 4.4775% | 3 | -54,563 | Q4 2017 |

| Cornerstone ondemand inc | CSOD | 7.97% | 328,382 | 4.6067% | 2.4744% | 4 | 64,011 | Q3 2018 |

| Twitter inc | TWTR | 20.91% | 540,628 | 4.3224% | n/a | 5 | 540,628 | Q4 2018 |

| Zendesk inc | ZEN | 42.78% | 258,885 | 4.2036% | n/a | 6 | 258,885 | Q4 2018 |

| Entegris inc. | ENTG | 41.40% | 522,345 | 4.0534% | n/a | 7 | 522,345 | Q4 2018 |

| Global payments inc. | GPN | 32.89% | 140,090 | 4.0189% | 1.8808% | 8 | 50,573 | Q3 2018 |

| Motorola solutions inc | MSI | 24.04% | 123,017 | 3.9368% | n/a | 9 | 123,017 | Q4 2018 |

| Rapid7 inc | RPD | 70.25% | 429,774 | 3.7254% | 5.1189% | 10 | -410,910 | Q2 2018 |

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.