Howard Mark’s Oaktree Capital navigated a volatile Q2 2019, returning 9.03%. That’s based on an equal-weighted portfolio of the fund’s top 20 holdings. It was the best quarterly return for large Hedge Funds — those with greater than $5 billion in 13F securities.

Oaktree’s diversivied portfolio served it well, with a gold stock — Anglogold Ashanti Ltd ADS (AU) . A pet airline — Azul SA ADR (AZUL). And a communications equipment company — Infinera Corp (INFN) the fund’s top Q2 performers.

Oaktree Capital – Q2’19 13F equal-weighted returns by security

| Stock | Q2 return |

| AU | 83.44% |

| AZUL | 51.47% |

| INFN | 44.68% |

| CZR | 24.86% |

| SBLK | 20.81% |

| ITUB | 12.89% |

| IBN | 8.14% |

| BR | 5.12% |

| ALLY | 4.06% |

| TSM | 3.31% |

| NMIH | 2.17% |

| BABA | -0.55% |

| CCS | -2.47% |

| PBR.A | -3.47% |

| SMCI | -3.60% |

| VST | -7.22% |

| CEO | -14.28% |

| TRMD | -17.44% |

| EGLE | -19.55% |

| EURN | -25.07% |

Los Angeles-based Oaktree Capital Management, L.P. was co-founded in 1995 by Chairman Howard Marks and five other partners. The investment firm focuses on high-yield bonds, distressed debt, private equity, real estate and equities. At year end 2018, the firm managed over $100 billion in assets. Oaktree reported 13F securities of $5.3 billion for Q2 of 2019.

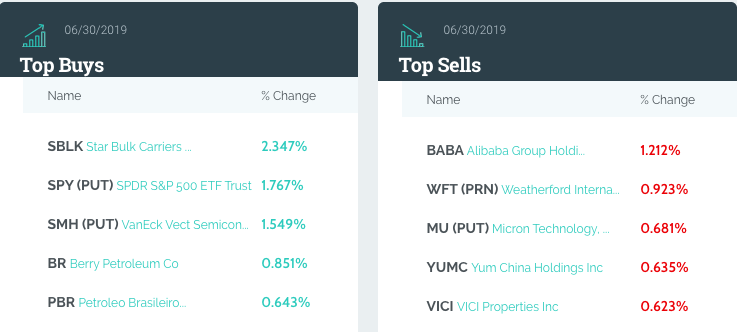

Howard Mark’s Oaktree Capital — Top buys and sells for Q2 2019

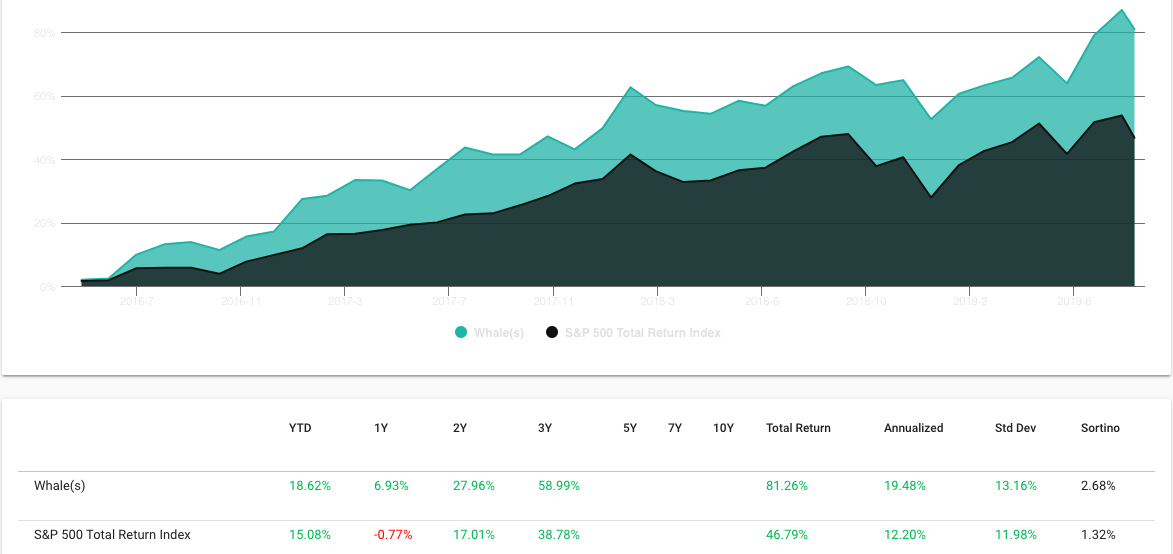

Since Q1 of 2016, Howard Mark’s Oaktree Capital has handily outperformed the S&P 500, its 13F portfolio returning 81.26% vs the S&P’s total return of 46.79%.

Marks has written several books, including Mastering the Market Cycle, Getting the Odds on Your Side. And The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful Investor.

The Oaktree Capital Chairman has been writing “Memo’s from Howard Marks” since 1990.

Marks is famous for his “Memo’s from Howard Marks” that he’s been writing since 1990. Over the last year his musings have turned cautious, and a recent post warns that “this time is different” thinking implies we’re late in the cycle.

“Think of a rocket launched from Cape Canaveral. Gravity has to be overcome in order for it to excape the earth’s atmosphere. Likewise, the limitations imposed by past norms have to be overcome in order for asset prices to slip their historic moorings and blast off into outer space. Today we’re not hearing much about historic valuations being irrelevant, as they’re not terribly high. Instead what we’re told is different this time is the relevance of restrictions on future economic and market performance:”

According to Marks, the following ideas represent “this time it’s different” thinking for this cycle.

- There doesn’t have to be a recession

- Continuous quantitative easing can lead to permanent prosperity

- Federal deficits can grow substantially larger with becoming problematic.

- National debt isn’t worrisome.

- We can have economic strength without inflation.

- Interest rates can remain “lower for longer.”

- The inverted yield curve needn’t have negative implications

- Companies and stocks can thrive even in the absence of profits.

- Growth investing can continue to outperform value investing in perpetuity”

He concludes the piece:

“…I’ll return to a concept I consider indispensable for anyone hoping succeed at investing — the three stages of a bull market:

- the first, when only a few forward-looking people begin to believe things will get better,

- the second, when most investors realize improvement is actually underway, and

- the third, when everyone concludes that things can only get better forever.”

The best investments often are made in times of fear and desperation. That’s rarely possible when investors are willing to blithely dismiss the limitations of the past with the words “this time it’s different.” I would remind those investors of a quote usually attributed to Mark Twain: “History doesn’t repeat itself, but it does rhyme.”

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). If you buy a book after clicking on one of the above links, I may received an affiliate fee. I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.