Engine Capital filed a 13D targeting PDL BioPharm (PDLI) on Wednesday morning, disclosing a 5.28% stake in the Nevada-based healthcare stock. Engine also disclosed it sent a letter to PDLI's board saying the fund "invested in PDLI because of the significant intrinsic value attributable to the Company’s existing assets...Engine believes that the Company is deeply...

Billionaire Mori Arkin filed a 13D on Aclaris Therapeutics (ACRS), a development stage microcap biotech company with a promising treatment for common warts. Arkin bought the shares through his personal partnership, "The 1999 Company." In the activist filing he disclosed the following trades:

Purchase/SaleSharesPriceDate Running

Total Stake

Purchase 603,0090.9779/6/19 603,009 Purchase 78,0440.9969/9/19

681,053...

Bill Gurley's Stitch Fix insider buying is his first ever as a corporate insider. Gurley bought $3.1 million of Stitch Fix, Inc. (SFIX) shares on the open market, increasing his personal stake by 25% to 755,000 shares. The tech dealmaker's purchases come as SFIX short interest has surged, reflecting bets that the personal stylings service stock is...

Whale Rock Capital's returns have been hard to beat. An equal-weighted portfolio of Whale Rock's top ten long 13F positions, rebalanced quarterly, has averaged a 17.30% annual return since the fund's inception in 2006. The fund's 10-year annualized performance of 25.57% is #2 among all fund's in the WhaleWisdom.com database. Over the last three years, the fund...

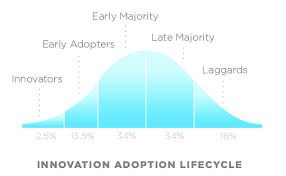

Cloning Carl Icahn is a good idea.

Now I'm of course not talking about a laboratory experiment whereby we create an army of little corporate activists that will grow into so many billionaires.

Rather, I'm referring to following the renowned activist's moves in and out of the stocks that he...

Hudson Executive Capital disclosed on Monday that it bought 143,200 shares of USA Technology (USAT) at $4.46 along with call options giving the fund the right to buy another 1,250,000 shares of stock at $10. The call options expire on Jan. 17, 2020.

Update: At 5:52 PM on Sept. 26, after the publication...

Baupost Group activist filings are rare events. Seth Klarman, the renowned value investor who heads Baupost, prefers to take passive stakes in companies. Since 2006, Baupost has filed 352 passive 13G filings, and made only 25 activist 13D filings, according to data from WhaleWisdom.com.

The returns of investors following Baupost into its activist positions...

Starboard Value 13Ds are worth paying attention to. The hedge fund, led by manager Jeff Smith, is one of the most prolific -- and successful -- activist funds.

Since 2011, Starboard has filed 305 activist reports: 47 initial 13Ds and 258 13D/A SEC filings. Over this period, investors who bought when Starboard filed...

Intra-Cellular Therapies FDA news release on Sept. 10 appeared positive. The FDA informed the company that it will not schedule an Advisory Committee meeting in connection with its review of the company’s new drug application (NDA) for Lumateperone for the treatment of schizophrenia. All good, moving ahead, right?

But in the world of medical...

Cigna Insider Buying is a rarity. Only one corporate insider had bought shares of the giant health insurer on the open market since 2003. That changed dramatically on Monday, as Cigna (CI) CEO David Cordani disclosed the purchase of 32,509 shares of his company's stock at $155.17. Cordani increased his ownership by 10% to 357,550 shares, a...