Home Search

13F - search results

If you're not happy with the results, please do another search

Michael Burry bought Tailored Brands at $13 in Q4 2018. An insider just purchased...

Michael Burry bought Tailored Brands at $13 in Q4 2018. But over four months later, a TLRD insider bought the tumbling stock...

Garelick Capital rides Ringcentral and Keysight for big performance

Garelick Capital Partners isn't exactly a household name in the Hedge Fund world. But that may change if the Boston-based hedge fund...

Smart Money accumulates Health Insurance Innovations

After regular market hours on Wednesday, the Head of Alternative Investments for B. Riley Capital filed Form 4s disclosing personal purchases of...

Hite Hedge was the top fund for Q4, profiting from MLP focus.

Investors who mimicked Hite Hedge Asset Management's long portfolio on Nov. 15 would have been up 29.49% through Feb 15., making Hite...

Michael Burry’s Scion hedge fund disclosed holdings for first time in 2 years. There...

Dr. Michael Burry's Scion Asset Management disclosed holdings on Feb. 15 for the first time in over two years. The investing legend...

The SEC charged him with insider trading. A jury acquitted him in 2015 after...

In May of 2015, Nelson Obus’s lawyer opened his client’s trial by saying that either the hedge fund manager is an honest man or "the lamest insider trader in history." Twelve years after he was first charged by the SEC for insider trading, Obus, the manager of New York-based hedge fund Wynnefield Capital Inc., was found not guilty by a jury.

Fast forward to January 14, 2019 and Obus just submitted an insider filing to his nemesis the SEC, disclosing that his fund purchased 20,000 shares of Landec Corp. (LNDC) at $11.33. It’s a trade that investors may want to note – not because of any alleged impropriety, but because the stock being bought may be an attractive opportunity.

Recency bias drives market bearishness – here’s what value-oriented insiders are buying

Stock market prognosticators are getting bearish. “We’re now in a bear market, get ready for lower prices…” a growing chorus of pessimistic “experts” are saying. “Watch out for the Death Cross!” Yikes.

Of course, this great advice comes after the market has already tanked 10%. Where was this helpful advice in Sept. before things went south in a hurry?

ValueAct Partners takes advantage of tech selloff, ups stake in Seagate

As tech stocks were battered last week, a hedge fund with a history of smart moves was buying. Activist Hedge Fund ValueAct Holdings reported on Nov. 23 that it upped its stake in Seagate Technology (STX) from 26.4 to 26.77 million shares. The purchases by the $16.48 billion fund, headed by Jeffrey Ubben, increased ValueAct’s ownership of STX to about 9.32%.

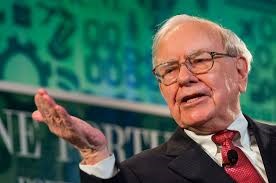

Berkshire Hathaway just added 4 new positions. A strategy that buys Buffett’s new picks...

Warren Buffett is generally regarded as the greatest investor of our time. That’s why every quarter, when Buffett’s fund Berkshire Hathaway updates portfolio holdings, Buffett followers scrutinize the reports, hoping to profit from the moves of the world’s 3rd richest person

Biotech stock Pfenex drifts lower despite big institutional buying, insider purchases

Insider buying and large 13F increases don’t always immediately translate into higher stock prices. A case in point is the development-stage biotech company Pfenex Inc. (AMEX:PFNX).