Home Search

13F - search results

If you're not happy with the results, please do another search

Hedge Funds were major buyers of micro-caps in the 2nd quarter.

Whether they’re called penny stocks, micro-caps, OTC stocks or “lottery tickets,” low-priced, illiquid stocks of small companies have a bad reputation with many investors. Unquestionably micro-cap stocks can be illiquid, risky and highly speculative. Nonetheless, Hedge Funds can and do hold lots of micro-caps.

Acuta Capital led the hedge fund pack with a 26.94% gain in the 2nd...

Acuta Capital Partners, LLC rode a surge in health care stock prices to the top spot in 2nd quarter hedge fund performance.

Tiger Pacific stumbles in the 2nd quarter.

The dubious distinction of worst hedge fund performance in the 2nd quarter -- based on equal weightings of 13F positions -- goes to Tiger Pacific Capital LP. An equal weighting of the fund’s 14 positions returned -21.69% in the quarter, according to WhaleWisdom.com

Insiders are accumulating Apple Hospitality – an oversold REIT with a 7% yield

It’s always good to see insiders buy a stock into price weakness -- it suggests the selloff is a buying opportunity, rather than a sign of more weakness to come. In the case of Apple Hospitality (NYSE: APLE), insider buying indicates executives who know the REIT best believe it’s oversold.

3 Newell Brands’ insiders – including Carl Icahn’s portfolio manager — bought $1.79 million...

Newell Brands (NWL) stock tumbled 22% over three days, but a long-time lieutenant of activist investor Carl Icahn was buying, picking up $1 million worth on August 8 at $20.50. In total, 3 directors of NWL bought $1.7 million of stock into the downdraft. The purchases were disclosed in Form 4 filings submitted today.

This oil service company is down 93% since 2014, but insiders are buying

Hornbeck industries (NYSE: HOS) stock has been on a tear since July 3 when a group of insiders disclosed acquiring a total of 24,550 shares at $4.00. HOS closed at $5.21 on June 29.

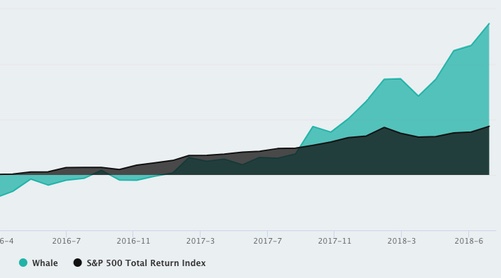

This leading hedge fund just made OnDeck Capital it’s #2 position – here’s why...

If history is any indication, On Deck Capital (NYSE:ONDK) stock is likely to trade higher in the months to come.

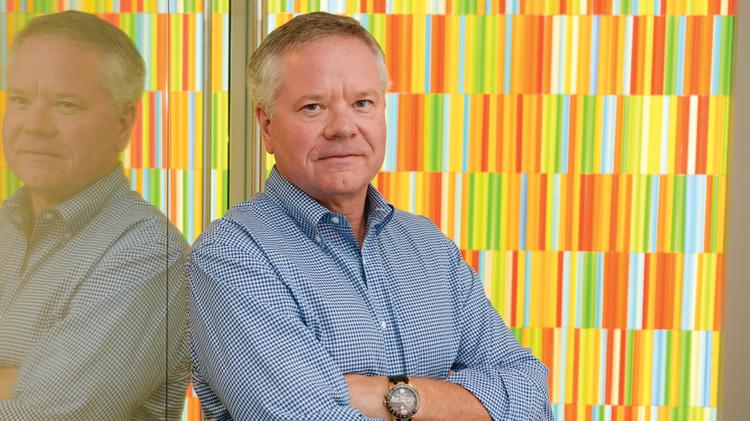

Here’s why a Texas billionaire is aggressively buying shares of Contango Oil.

John C. Goff, a Texas Billionaire investor and chairman of Fort Worth-based Crescent Real Estate, filed a 13D on June 13 disclosing an 18.3% position in Houston-based Contango Oil and Gas ( MCF $5.91).

Cronos Group attracts institutional investment ahead of Canadian cannabis legalization vote

Cronos Group is a Canada-based marijuana producer seemingly well positioned to capitalize on the expected Canadian legalization of recreational marijuana later in the summer of 2018.

About us

WhaleWisdom Alpha is focused on researching and profiting from the “smart money” disclosures of hedge funds, professional investors and corporate insiders. Every...