Solid Biosciences' private placement featured investments by an all star list of top biotech institutional investors.

Cambridge-based Solid Biosciences (SLDB) trades at 1/3 of its January 2018 IPO value. But based on the A-list biotech investors buying shares in the company's July 26 $60...

Lottery ticket stocks are equities perceived by investors to provide a small chance of a huge payoff. Like playing the lottery, many investors find these stocks -- usually low-priced, thinly traded with little or no earnings -- very alluring. However, studies show that -- like the...

Light Street Capital filed a 13G on Monday July 22, disclosing a 5.2% stake in cybersecurity firm Carbon Black, Inc. (CBLK).

The Palo Alto-based hedge fund acquired the $69 million CBLK position as cyber attacks become an increasing problem for U.S. corporations, and...

Abdiel Capital Advisors has never held more than 9 long positions since the 4th quarter of 2015. Over that period, the $1.4 billion hedge fund has averaged a 55.1% annual return (based on 13F filings). Abdiel's portfolio concentration is anathema to Modern Portfolio Theory, which preaches diversification...

The Tiger Cub Hedge Funds market-beating performance continues. Though Julian Robertson's Tiger Management folded up its tent nearly two decades ago, his protégés are doing him proud. A portfolio of top holdings of hedge funds linked to Tiger Management was up 14.94% year-to-date through Q2's end. That's...

Twenty-two minutes after regular market hours closed on July 2, an Orbimed Advisors Form 4 relating to Corvus Pharmaceuticals Inc (CRVS) was posted on the SEC's website. The hedge fund, a 10%+ holder and insider in CRVS, disclosed that between June 27 and July 1 it...

On June 28, Archon filed a 13G on AquaBounty Technologies Inc (AQB) , disclosing a passive 8.39% position. In 2020 AquaBounty is set to sell the only genetically engineered (GE) animal in the world that’s been deemed safe to eat: Atlantic salmon modified to grow faster.

Macerich insiders have bought a record $2.8 million of the retail mall developer's stock over the last two months as Macerich (MAC) shares hit seven year lows.

A great story needs a great title. And what could be better than "Retail Apocalypse" to capture...

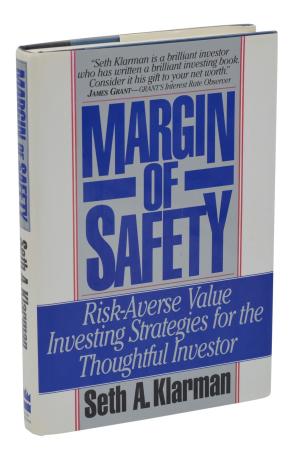

In 1991 the first (and only) edition of Seth Klarman's book Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor was published. Just 5000 copies were printed, and initial sales were slow. You could have bought it for $25. Today, it might be worth $3000.

U.S. Hedge Funds are buying cannabis stocks. Despite regulatory issues and limited investment choices, the "smart money" is increasingly eager to gain exposure to the booming marijuana sector.

But you won't see Warren Buffett and Charlie Munger jumping on the pot stock...