If you had to choose one fund to follow, Tiger Global might be it. Chase Coleman's Tiger Global has been the best large hedge fund over the last 3 years. At least based on long-only positions disclosed via 13F filings. Copying or "cloning" Tiger Global's long positions...

A Mellanox (MLNX) insider bought $2.2 million of the Israeli chip designer as fears China will block a proposed merger with Nvidia Corp (NVDA) pushed the price of MLNX well below the buyout price.

Stephen Sanghi, a director of Sunnyvale-based Mellanox since February...

Obscure stocks -- publicly traded, unknown, hidden companies with little or even no analyst coverage -- may not seem like good investments. Seriously, who wants to invest in a stock no one has ever heard of? Some of the top hedge fund managers in the world, that's...

Scion's ADV Part 2 filed with the SEC provides insights into the business practices and strategies of renowned investment manager Dr. Michael Burry.

One of the world's most intriguing fund managers, Burry made himself -- and investors in his Scion...

We can assume that the 50 best performing hedge funds over the last few years have been doing something right. The managers of the top 50 funds exploited an edge the other 930 hedge funds in WhaleWisdom universe didn't have.

No doubt there is...

Two Waitr Holdings (WTRH) insiders combined for a $1.07 million buy of the food delivery company's shares on Monday.

The Waitr insiders' purchases came after a March 20, 2019 report by short research firm "The Friendly Bear" ravaged WTRH stock. The report was entitled:...

The top Q1 2019 hedge fund was S Squared Tech, beating the other 979 hedge funds in the WhaleWisdom.com universe. S Squared's 19.8% return is based on 13F filings. For comparison, the S&P 500's total return was 3.2%.

Below are the top five...

Dr. Michael Burry's Scion Asset Management disclosed its first quarter 2019 holdings, and in a surprise, China online retailer JD.com (JD) was the hedge fund's top position. Altaba Inc. (AABA), owner of 15% of China e-commerce giant Alibaba (BABA),was Scion's #2 position.

Burry, featured...

Its 13F filings season again -- when hedge fund managers show their hands.

Forty-five days after the end of every quarter, every U.S. institutional investor with assets over $100 million is required to report its holdings to the SEC via 13F filings. Last quarter...

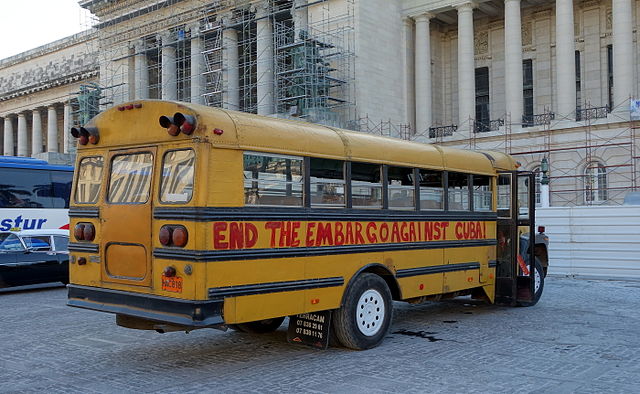

On April 30, Phillip Goldstein disclosed a 9.9976% position in Herzfeld Caribbean Basin Ltd. (CUBA). In a 13D filing, Goldstein said that if the founder and manager of the CUBA closed-end fund was to "dissolve" it, shareholders would gain "about 25%."

Goldstein is...