Replicating Baker Brothers holdings, using 13F filings submitted quarterly by the life sciences hedge fund, has been an awesome strategy over the years. But by focusing on the smaller stocks owned by the fund, returns were even better.

Baker Bros Advisors LP, with $17.33...

The Lottery Ticket Stocks Q2 2019 portfolio was down 6.72% for the quarter, tracking the Russell 2000 Index lower. However, the portfolio of top hedge funds' most speculative holdings, rebalanced quarterly based on 13F filings, was up 35.65% year-to date as of August 15.

Lottery ticket stocks are equities perceived by investors to provide a small chance of a huge payoff. Like playing the lottery, many investors find these stocks -- usually low-priced, thinly traded with little or no earnings -- very alluring. However, studies show that -- like the...

Twenty-two minutes after regular market hours closed on July 2, an Orbimed Advisors Form 4 relating to Corvus Pharmaceuticals Inc (CRVS) was posted on the SEC's website. The hedge fund, a 10%+ holder and insider in CRVS, disclosed that between June 27 and July 1 it...

Obscure stocks -- publicly traded, unknown, hidden companies with little or even no analyst coverage -- may not seem like good investments. Seriously, who wants to invest in a stock no one has ever heard of? Some of the top hedge fund managers in the world, that's...

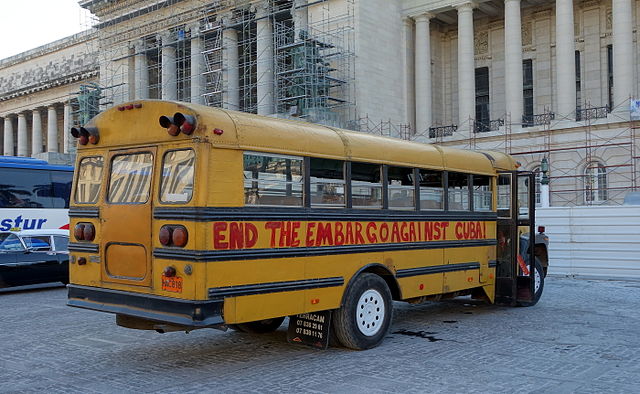

On April 30, Phillip Goldstein disclosed a 9.9976% position in Herzfeld Caribbean Basin Ltd. (CUBA). In a 13D filing, Goldstein said that if the founder and manager of the CUBA closed-end fund was to "dissolve" it, shareholders would gain "about 25%."

Goldstein is...

Last week, three insiders from Maiden Holdings, Ltd. (MHLD) filed Form 4s disclosing the purchase of 380,000 shares at an average price of $0.78 per share. An interesting cluster of buying. But here's what's astonishing -- just seven months earlier the stock traded at $8.75.

On February 28 , Martha Stewart's Sequential Brands (SQBG) announced that the lifestyle celebrity has teamed up with Canopy Brands (CGC) to develop and promote a line of hemp-based CBD products. SQBG stock spiked higher on the news, nearly doubling at one point before settling at $2.00...

Hedge fund managers with hundreds of millions of dollars rarely buy the illiquid shares of a micro-cap company -- but when they do it's often a prelude to much higher prices for that stock. Below I discuss the 13F "secret" to uncovering micro-cap winners as the "Whales"...

Whether they’re called penny stocks, micro-caps, OTC stocks or “lottery tickets,” low-priced, illiquid stocks of small companies have a bad reputation with many investors. Unquestionably micro-cap stocks can be illiquid, risky and highly speculative. Nonetheless, Hedge Funds can and do hold lots of micro-caps.