At the Sohn San Francisco Investment Conference last year, Gil Simon of SoMa Equity Partners presented his best idea: SailPoint Technologies (SAIL). The Sohn conference is renowned as an annual event where hedge fund managers make market-moving presentations. Indeed, after Simon — a rising star in the hedge fund world — made his pitch, SAIL stock went on a run. However, since last October, SAIL has not been SoMa’s best performing position — far from it. While SoMa’s long portfolio has outperformed, Simon’s best idea SAIL has been an average performer. It’s a well known secret: A hedge fund manager’s “best idea” is no better than other portfolio holdings.

This “secret” is confirmed by a recent report that analyzed the 13F stock picks of nearly 1,500 hedge funds over 20 years. “The focus on hedge fund stock picks at idea conferences and events is misguided and possibly counterproductive,” said the researchers from New York University and Epsilon Asset Management. “Our analysis points to no systematic outperformance of these best ideas versus other portfolio positions held by hedge fund managers, across all size funds, and over all time periods.”

Recent research suggests “top ideas” hyped at conferences by hedge fund managers aren’t so special.

Hedge fund managers’ top picks did produce “statistically significant alpha” — meaning they beat the market averages — but only at roughly the same rate as the rest of the portfolios, the study found.

The report also found that alpha was “demonstrably greater” in the decade before the global financial crisis than the decade after it, and that smaller funds have generally produced more alpha than their larger competitors.

For investors seeking to “clone” or otherwise profit from analyzing the holdings of leading hedge fund managers, the study begs the question: If a manager’s “best idea” is no better than his or her other 50 ideas, how many of a given fund’s positions should be held to optimally capture a managers alpha?

Using WhaleWisdom.com’s 13F Backtester, we can test the historical performance of replicating 13F portfolios based on position rankings. We can see what returns one might have achieved by holding the best idea of a given fund. There are various ways one could define “best idea.” The study above used five different measures. For this backtest we’ll define “best idea” as simply the position that represents the largest % of the fund’s portfolio based on dollar value.

Backtests show replicating funds’ #1 positions underperforms strategies that hold portfolios of funds’ broader holdings

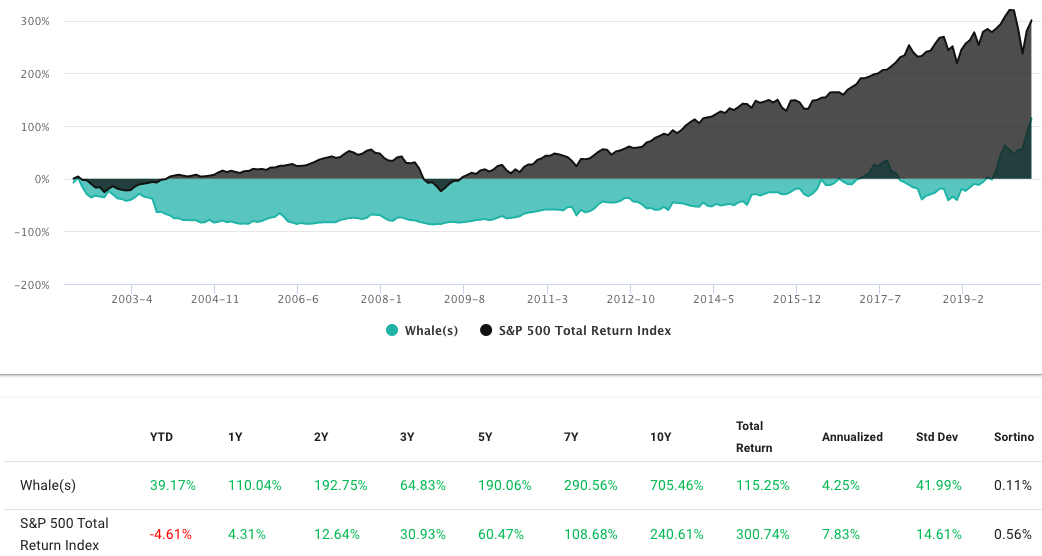

Let’s construct a rolling portfolio consisting of five leading hedge funds’ #1 holdings: Baker Bros., Perceptive Advisors, Tiger Global, Lone Pine Capital and Whale Rock Capital.

Beginning in Q1 of 2010, we replicate the top holding of each fund at the end of each quarter. (13F filings are released 45 days after the end of every calendar quarter.) Then every quarter going forward, we rebalance as needed to continually hold a five stock portfolio consisting of each fund’s #1 holding. Here is the historical performance of that strategy:

Over the last ten years, the annualized return of an equal-weighted portfolio consisting of each funds’ top position returned 4.25% annually — underperforming the S&P 500’s total return by 3.5%. Not spectacular.

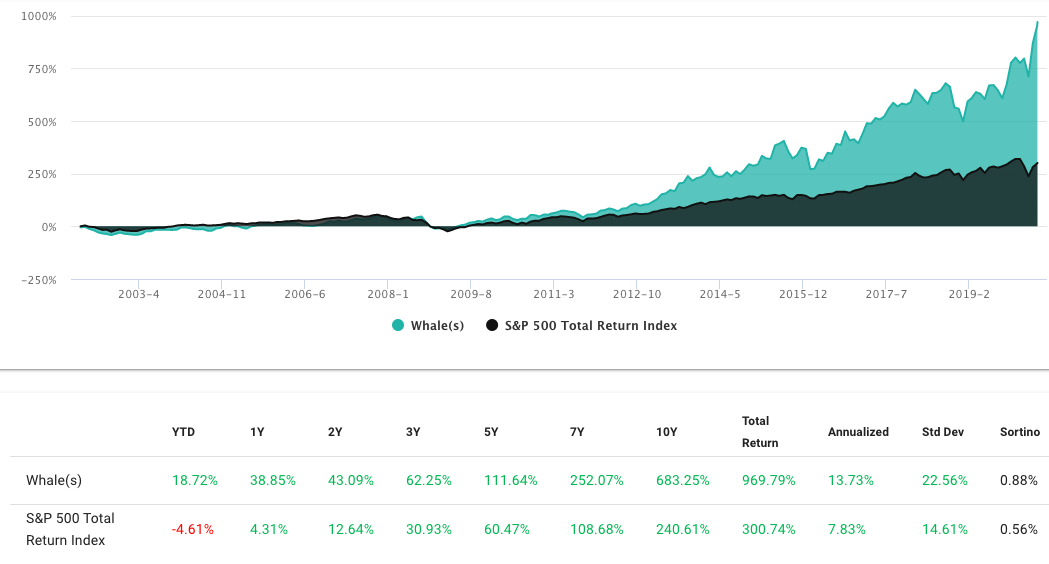

Now let’s backtest the top 5 holdings of each fund. We simply hold an equal-weighted portfolio consisting of 25 positions — the top five holdings of each of the five funds.

The annualized return of this strategy, 13.73%, is nearly double the S&P 500 total return index.

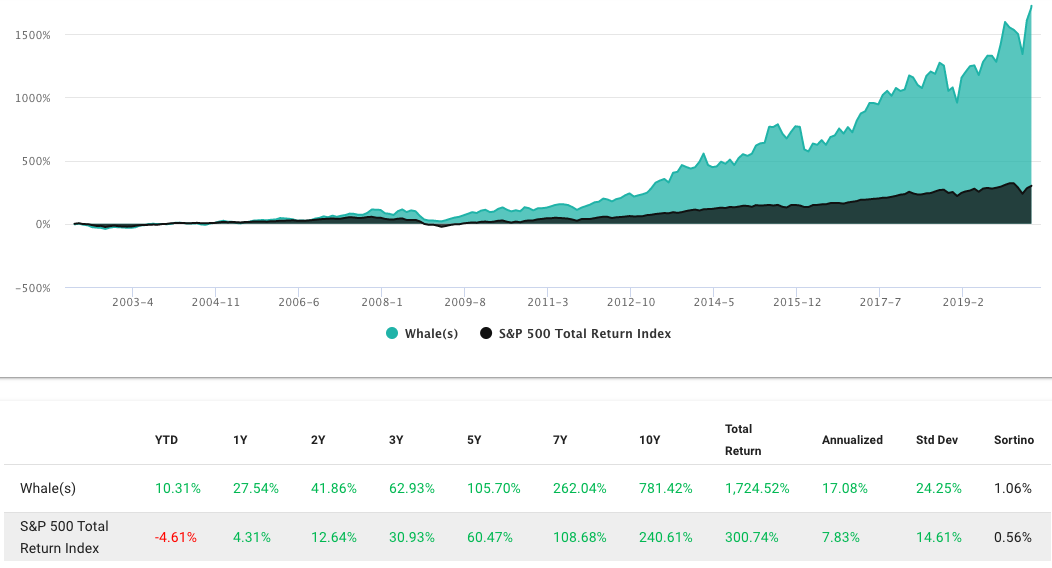

Next, we test a combined % portfolio consisting of each fund’s top holdings. This test will hold and rebalance a 50 stock portfolio. We determine the securities to hold by calculating the percentage every stock represents in each fund’s portfolio, then buy the top 50 largest % positions.

The best returns may be achieved by focusing on “new ideas” rather than “top holdings.”

Even better performance.

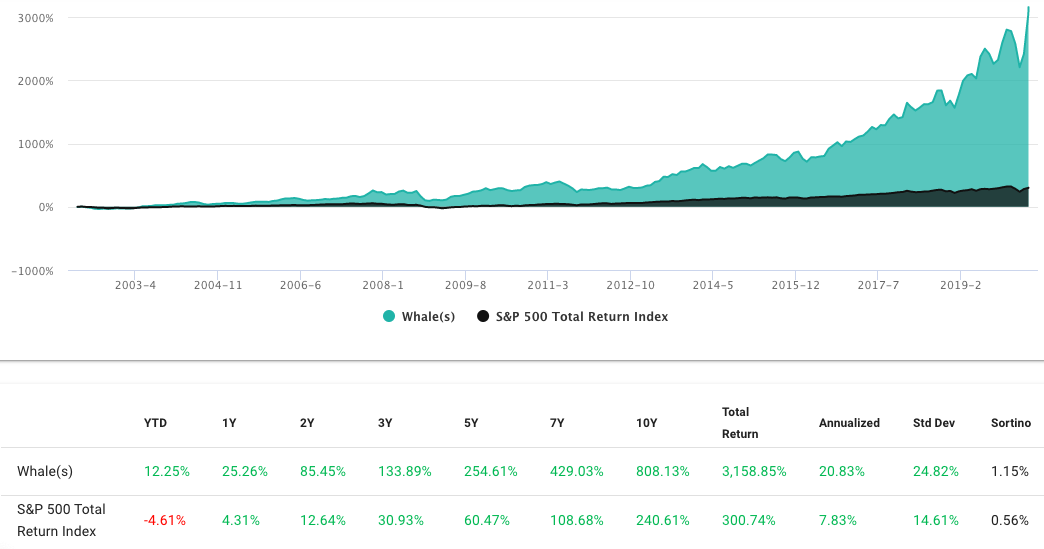

Finally, let’s backtest a portfolio consisting of the new holdings disclosed by each fund every quarter. Possibly a hedge fund manager’s “best ideas” consist of new ideas added to the portfolio. Here we create a % of portfolio test as above, then hold and rebalance the top 10 new positions of the combined funds.

Over the last 10 years, if we held a portfolio of the top ten new positions of Baker Bros., Perceptive Advisors, Tiger Global, Lone Pine Capital and Whale Rock Capital, and rebalanced quarterly, we would achieved a 20.83% annualized return.

Here is the portfolio purchased on May 18 based on the “new positions” backtest. Some great returns already.

| Stock | % of Port | Buy Date | Return since |

| ZM Zoom Video Communications Inc | 10.00% | 5/18/20 | 23.96% |

| V VISA Inc | 10.00% | 5/18/20 | 1.55% |

| DOCU DocuSign Inc | 10.00% | 5/18/20 | 19.77% |

| JD JD.com Inc ADR | 10.00% | 5/18/20 | -1.44% |

| HWM Howmet Aerospace | 10.00% | 5/18/20 | 8.59% |

| INTC Intel Corp. | 10.00% | 5/18/20 | 3.23% |

| LB L Brands Inc | 10.00% | 5/18/20 | 29.52% |

| MU Micron Technology, Inc. | 10.00% | 5/18/20 | 0.91% |

| ZS Zscaler Inc | 10.00% | 5/18/20 | 49.00% |

| LRCX Lam Research Corp. | 10.00% | 5/18/20 | 5.25% |

So, the bottom line: Rather than focusing on a given hedge fund manager’s “best idea,” you’re likely better off replicating a diversified, equal-weight portfolio of a fund’s top 10 or 20 holdings, or even creating portfolios based on new positions.

You can follow 13Fs, insider buying and other SEC filings at WhaleWisdom.com.

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.