Macerich insiders have bought a record $2.8 million of the retail mall developer's stock over the last two months as Macerich (MAC) shares hit seven year lows.

A great story needs a great title. And what could be better than "Retail Apocalypse" to capture the demise of brick-and-mortar retail. For investors, the phrase conjures...

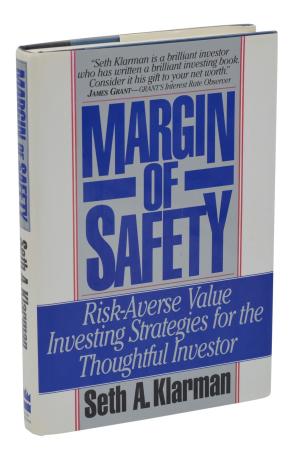

In 1991 the first (and only) edition of Seth Klarman's book Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor was published. Just 5000 copies were printed, and initial sales were slow. You could have bought it for $25. Today, it might be worth $3000.

Assuming you didn't dogear the pages, highlight...

As gold's ascent gains momentum, investors looking for ways to play the gold rally may want to analyze the gold stocks hedge funds have been buying.

Gold hit a five year high on Friday as rate cut expectations, dollar weakness, trade war fears and global tensions all continued to support gold prices. Gold futures...

U.S. Hedge Funds are buying cannabis stocks. Despite regulatory issues and limited investment choices, the "smart money" is increasingly eager to gain exposure to the booming marijuana sector.

But you won't see Warren Buffett and Charlie Munger jumping on the pot stock bandwagon. The investing icons told Fox News in early May...

If you had to choose one fund to follow, Tiger Global might be it. Chase Coleman's Tiger Global has been the best large hedge fund over the last 3 years. At least based on long-only positions disclosed via 13F filings. Copying or "cloning" Tiger Global's long positions quarterly, would have returned a big-fund leading 22.37% annually since...

A JC Penny (JCP) insider disclosed on Monday afternoon a nearly $1 million purchase of JCP stock at $0.99 cents. JCP traded at $1.91 as recently as March 12, but in recent weeks speculation has intensified that a bankruptcy filing by the 117-year-old retailer was fast approaching.

Javier G Teruel bought 941,095 shares of...

A Mellanox (MLNX) insider bought $2.2 million of the Israeli chip designer as fears China will block a proposed merger with Nvidia Corp (NVDA) pushed the price of MLNX well below the buyout price.

Stephen Sanghi, a director of Sunnyvale-based Mellanox since February of last year, disclosed yesterday afternoon the purchase of 20,000...

Obscure stocks -- publicly traded, unknown, hidden companies with little or even no analyst coverage -- may not seem like good investments. Seriously, who wants to invest in a stock no one has ever heard of? Some of the top hedge fund managers in the world, that's who.

In the first quarter of 2019,...

Scion's ADV Part 2 filed with the SEC provides insights into the business practices and strategies of renowned investment manager Dr. Michael Burry.

One of the world's most intriguing fund managers, Burry made himself -- and investors in his Scion hedge fund -- hundreds of millions shorting sub-prime mortgages during...

American Capital Investment Corp (AGNC) insider buying by CEO and CIO Gary Kain suggests the current neutral interest rate environment is supportive of AGNC's 11.5% dividend yield.

Kain bought $1.89 million of the gov't-back mortgage REIT on May 28. Kain's Form 4 disclosed a $1.65 million purchase of common AGNC...