On May 6, Arconic Inc.'s (ARNC) insiders disclosed the purchase of $1.6 million of stock as the aluminum-parts maker announced additional share buybacks and clarified plans for a spinoff.

Chairman and CEO John Plant bought 50,000 shares of ARNC at $22.14. Since March...

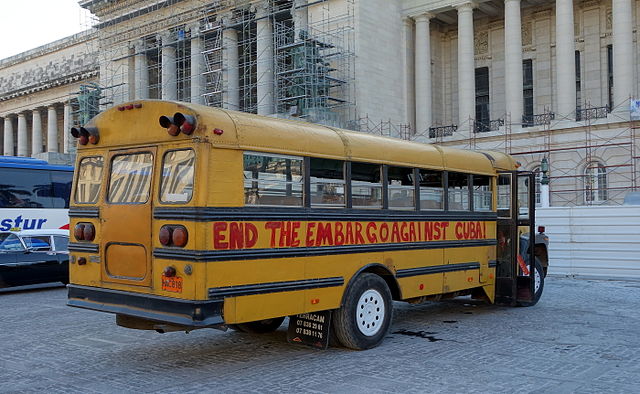

On April 30, Phillip Goldstein disclosed a 9.9976% position in Herzfeld Caribbean Basin Ltd. (CUBA). In a 13D filing, Goldstein said that if the founder and manager of the CUBA closed-end fund was to "dissolve" it, shareholders would gain "about 25%."

Goldstein is...

A.H. Belo (AHC) was the target Wednesday afternoon of a 13D filing by Minerva Advisors LLC. The hedge fund disclosed a 5.1% activist ownership position in the publisher of the Dallas Morning News, and said the company should go private. From the 13D filing:

Last week, three insiders from Maiden Holdings, Ltd. (MHLD) filed Form 4s disclosing the purchase of 380,000 shares at an average price of $0.78 per share. An interesting cluster of buying. But here's what's astonishing -- just seven months earlier the stock traded at $8.75.

On Friday, Engaged Capital LLC, a big holder of Hain Celestial Group, announced it bought $19 million more of HAIN, even though the stock had popped 10% over the previous couple days.

Often, corporate insiders buy into share weakness...

Paul Singer’s Elliott Management is the largest and arguably the most successful activist hedge fund. So when Singer first buys a stake in a stock, that company’s management shudders, and the share price jumps. Singer’s 13D filing usually means higher prices in the target stock in the...

Home Depot co-founder Ken Langone, 83, is famously frugal. In an interview with CNBC last year the multi-billionaire told of challenging the cable company’s $200 bill for his Manhattan apartment’s service. “The point I'm making is it's not that I'm cheap, it's just that I want to make sure I don't squander money," Langone says.

On December 27, 2018, Cannell Capital LLC — a hedge fund based in Alta, Wyoming – disclosed sending three separate letters to three company managements, notifying them of Cannell’s activist intentions. Buying the stocks targeted by Cannell on that date would have produced an average gain of 32.40% over the 25 trading days since.

Newell Brands (NWL) stock tumbled 22% over three days, but a long-time lieutenant of activist investor Carl Icahn was buying, picking up $1 million worth on August 8 at $20.50. In total, 3 directors of NWL bought $1.7 million of stock into the downdraft. The purchases were disclosed in Form 4 filings submitted today.

By Mark W. Gaffney

For WhaleWisdom.com

As of May 1, 2018, over 5,200 stock positions were held by the 55 funds classified as activist investors. That’s according to data from WhaleWisdom.com. Most of these stocks will be unremarkable performers, generating little alpha for the fund or investors.

But hidden among the many...