As we've previously written, when insiders as a group buy en masse, it has historically signaled that stocks were broadly undervalued and a market bottom was at hand. As of Friday's close, the WhaleWisdom Insider Sell vs Buy Ratio for the week of Feb. 24 was 1.42. This ratio reflected 467 selling transactions by officers and directors...

High yielding stocks offer potential for double-barreled returns – big dividend payments and price appreciation. However, many stocks with large dividend yields are "accidental high yielders." These are stocks where some fundamental problem -- an earnings shortfall, for instance -- has put pressure on the stock price. But the dividend remains unchanged. Of course, the question then is: Will...

What do Abdiel Capital, Citadel Advisers, Dragoneer Investment Group, Melvin Capital, Point 72 Asset Management, Tiger Global and Whale Rock Capital have in common? Aside from being among the world's leading hedge funds, Bill.com 13F holdings reveal all the above bought shares of Bill.Com (BILL) in Q4 of 2019.

It was a good move....

Michael Burry's Scion Asset Management released its 13F showing the hedge fund's holdings at year end. Gamestop Corp (GME) remained the fund's top holding, though Scion's Q4 2019 13F showed Burry had reduced his GME position by 21% during the quarter. Maxar Technologies Ltd (MAXR), a new position, was Scion's #4 holding.

Here is...

Spirit Air insider Christine Richards bought 5000 shares of the discount airline despite worries Coronavirus could impact global travel. Richards was appointed director at Spirit Airlines Inc. (SAVE) in Sept. of last year. A Form 4 filed today disclosed the purchase of $216K of SAVE at $43.24.

As Executive VP and General Counsel...

Otto von Bismarck, the "Iron Chancellor," engineered the unification of Germany in the 1870s. Bismark's close adviser and confident was a German-Jewish banker, Gerson von Bleichroeder. Bleichroeder's bank played a key role in Bismarck's ascension to power, helping to bankroll the German Empire. Now, a century-and-a-half later, a "new" hedge fund, Bleichroeder L.P., with roots dating...

Director Stephen Luczo bought $3.7 mil of AT&T(T) at $37.60 on Feb.4. It was Luczo's -- who is also Chairman of the Board at Seagate Technology(STX) -- first open market purchase of AT&T shares since becoming a director in November.

Luczo's history as a corporate insider dates back to August of 2003 when he...

I'm “done with fossil fuels." That's what Jim Cramer just said on CNBC's Squawk Box. Cramer compared fossil fuel companies to the stigmatized tobacco companies, saying oil stocks are in the “death knell phase.” But if that's true, I wonder why billionaire oil tycoon and hotelier Bob Rowling just bought $5.6 million of beaten down Northern Oil...

In a 13D filed on Jan. 21 targeting Garrison Capital (GARS), corporate activist Joseph Stilwell notes that he has taken an "activist position" in 68 publicly-traded companies since 2000.

In his most recent 13D, Stilwell Value, LLC disclosed a 5% stake in Garrison, a closed-end investment company. Stilwell affiliates acquired 804,980 shares of GARS...

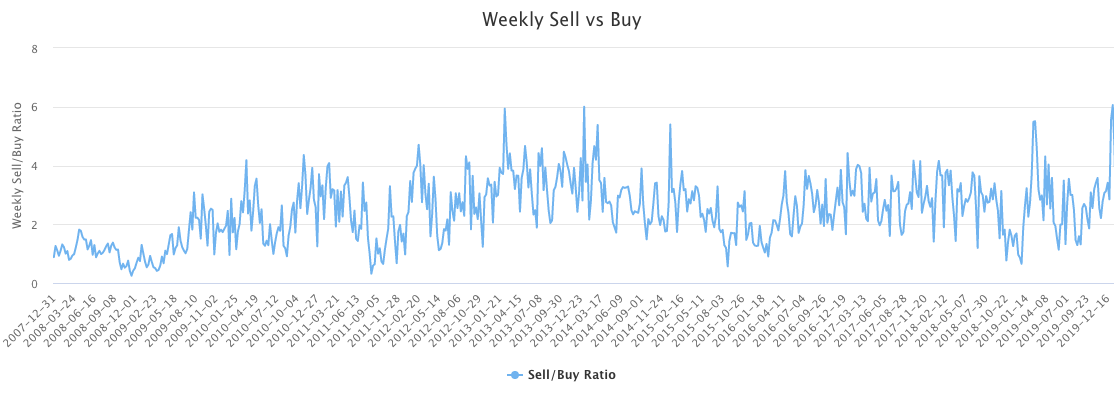

"Insiders are selling stock like it's 2007." That's a headline from August 27, 2019. Sounds ominous. One might have been inclined to think: The smart guys are dumping stock, guess I should too. Well that would have been a big mistake. Since that headline was posted, the S&P 500 is up over 15%. The Nasdaq 100 Index...