In a 13G filed Friday evening, Citadel Advisors disclosed a 19.9% Avianca Holdings (AVH) stake. Ken Griffin's hedge fund reported that it owns 82,364,111 preferred shares of AVH issued to Citadel in exchange for a $356 million investment in Avianca.

To be sure, the AVH investment represents a small fraction of...

Legion Partners disclosed a 5.15% stake in Landec Corp (LNDC) after market hours on Thursday. The hedge fund stated it believes LNDC's stock price "does not reflect the Issuer’s intrinsic value." Legion believes that Landec is "engaged in an odd combination of businesses that will never achieve full and fair value in the Issuer’s current structure."

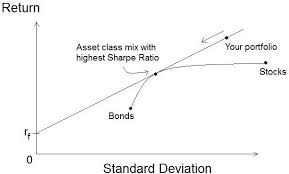

The Sharpe ratio is a popular way to measure the return of an investment compared to the amount of risk taken. Risk is measured as volatility or standard deviation. So, the equity managers with the highest Sharpe ratios in the WhaleWisdom database have demonstrated skill picking stocks with market beating returns. However, their picks have shown relatively...

Due to to years of lagging performance, investors have largely abandoned energy stocks. But with the recent explosion of U.S - Iran tensions, oil stocks are suddenly in the spotlight again. Investors must now consider the possibility that a Mid East war could cause a "super spike" in oil prices to $150 per barrel. It's a good...

ConAgra insider Craig Omtvedt bought $1.35 million of the food giants's stock two weeks after ConAgra Brands Inc (CAG) reported surprisingly good earnings and upped its guidance. CAG hit 52-week highs after the report. Omtvedt's Form 4 disclosing his purchase came after market hours on Jan. 3.

Omtvedt has been a director of...

On Dec. 23, Nierenberg Investment filed a 13D/A on Houston Wire and Cable (HWCC). The investment adviser expressed frustration that the market value of its long-held position in the micro-cap has "widened substantially over the last two years."

The filing amended a 13D from Dec.17 of 2018 in which the investment adviser disclosed...

The decade's top 20 hedge funds did something remarkable: They handily outperformed the S&P 500 -- a difficult accomplishment during the relentless bull market.

The S&P 500 total return index has averaged about a 13.5% annual return over the last decade. But the average fund on the top 20 hedge fund list returned...

Myriad Genetics co-founder Walter Gilbert PhD bought $150K of MYGN on Dec. 13 @ $25.60. Gilbert, who won the Nobel Prize for Chemistry in 1980, has a history of Form 4 filings at Myriad dating back to 2006. However, this is the insider's first open market purchase of MYGN shares.

Gilbert received a...

Engine Capital filed a 13D on Cymabay (CBAY) two weeks after the development stage biotech company halted a trial of its leading drug candidate causing it's shares to fall as much as 75%.

In a 13D filing Thursday evening, New York-based Engine Capital, L.P. disclosed a 7.3% stake in CBAY. The hedge fund reported...

Perceptive Advisors' Neptune Wellness Solutions (NEPT) position increased by 50% during the 3rd quarter of 2019, to 4.5 million shares. The stake represents 14.53% of the Cannabis extraction company's outstanding shares. NEPT was Perceptive Advisors' #20 position at Q3 close.

The increase in Perceptive' Advisors' Neptune Wellness stake came amidst a terrible 2019 for...