Starboard Value 13Ds are worth paying attention to. The hedge fund, led by manager Jeff Smith, is one of the most prolific -- and successful -- activist funds.

Since 2011, Starboard has filed 305 activist reports: 47 initial 13Ds and 258 13D/A SEC...

On August 30, Scion Capital filed a 13D on Tailored Brands(TLRD) disclosing a 5.18% position in the troubled formal apparel retailer that owns Men's Warehouse and Jos. A. Bank. Michael Burry's hedge fund also disclosed three separate letters sent to management in recent weeks. In the letter...

Michael Burry as activist investor? It doesn't seem likely that the famously media-shy hedge fund manager would take a page from Carl Icahn's playbook, but that's just what appears to be happening.

Burry told Barron's in an article published Wednesday that Scion Asset...

Starboard Value cut its Cars.com stake aggressively after the online auto retailer's strategic search failed and the company announced disappointing Q2 results. In a 13D/A filing submitted Wednesday afternoon, the hedge fund disclosed selling 4.47 million shares of the online automobile retailer on August 5-6 at...

Activist Cannell Capital raised its stake in Lee Enterprises (LEE) to 7.37%. The hedge fund filed a 13D/A on July 30 disclosing a 1.7 million additional share purchase of the newspaper publisher. Cannell is now LEE's largest shareholder.

Lee Enterprises owns 49...

Light Street Capital filed a 13G on Monday July 22, disclosing a 5.2% stake in cybersecurity firm Carbon Black, Inc. (CBLK).

The Palo Alto-based hedge fund acquired the $69 million CBLK position as cyber attacks become an increasing problem for U.S. corporations, and...

On June 28, Archon filed a 13G on AquaBounty Technologies Inc (AQB) , disclosing a passive 8.39% position. In 2020 AquaBounty is set to sell the only genetically engineered (GE) animal in the world that’s been deemed safe to eat: Atlantic salmon modified to grow faster.

A Mellanox (MLNX) insider bought $2.2 million of the Israeli chip designer as fears China will block a proposed merger with Nvidia Corp (NVDA) pushed the price of MLNX well below the buyout price.

Stephen Sanghi, a director of Sunnyvale-based Mellanox since February...

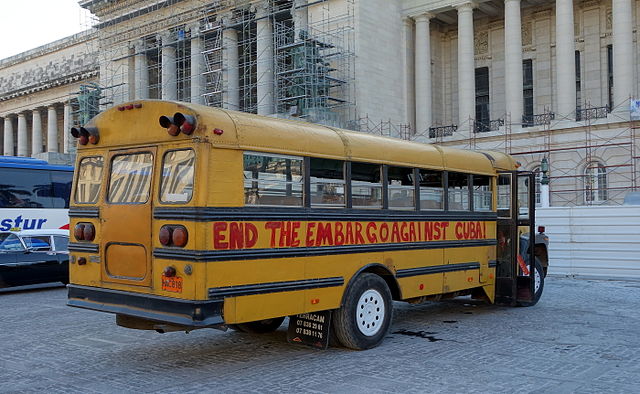

On April 30, Phillip Goldstein disclosed a 9.9976% position in Herzfeld Caribbean Basin Ltd. (CUBA). In a 13D filing, Goldstein said that if the founder and manager of the CUBA closed-end fund was to "dissolve" it, shareholders would gain "about 25%."

Goldstein is...

A.H. Belo (AHC) was the target Wednesday afternoon of a 13D filing by Minerva Advisors LLC. The hedge fund disclosed a 5.1% activist ownership position in the publisher of the Dallas Morning News, and said the company should go private. From the 13D filing: