Continuing the series on the greatest insider trades: On October 15, 2018, Citigroup (NYSE:C) reported Q3 2018 EPS of $1.73 on revenues of $18.39B, generally in line with expectations. Trading near $70, Citi has a market cap of $175 billion, and is one of the premiere U.S. financial institutions.

Shareholders of Basic Energy Services (BAS) recently saw that stock’s price cut by a third over two days. However, three company insiders viewed the drop as a buying opportunity, significantly increasing personal holdings via open market purchases.

A Mellanox (MLNX) insider bought $2.2 million of the Israeli chip designer as fears China will block a proposed merger with Nvidia Corp (NVDA) pushed the price of MLNX well below the buyout price.

Stephen Sanghi, a director of Sunnyvale-based Mellanox since February...

Jeff Bezos sold $3B of Amazon stock on Nov. 2 - Nov. 3. The world's richest person unloaded 1 million shares of his company at an average price of $3022.84. Amazon(AMZN) closed today at $3143.74, down 4.57%. The sales reduced the founder's stake in the giant online...

General Electric (GE), once the bluest of blue-chip stocks, has fallen hard. Since the end of 2016, GE’s market cap has dropped by 70% -- from $277 billion to $83 billion. In June GE was dropped from the Dow Jones Industrial Average after more than a century. The stock now trades at $9.30, down nearly 50% year-to date.

Two Waitr Holdings (WTRH) insiders combined for a $1.07 million buy of the food delivery company's shares on Monday.

The Waitr insiders' purchases came after a March 20, 2019 report by short research firm "The Friendly Bear" ravaged WTRH stock. The report was entitled:...

Cigna Insider Buying is a rarity. Only one corporate insider had bought shares of the giant health insurer on the open market since 2003. That changed dramatically on Monday, as Cigna (CI) CEO David Cordani disclosed the purchase of 32,509 shares of his company's stock at $155.17....

In a March 28 Form 4 filing, two Winnebago Industries Inc. insiders disclosed buying a total of 6,000 shares of the Recreational Vehicle maker at $29.35.

Michael Happe, President and CEO of Winnebago (WGO) since January of 2016, bought 3500 shares, increasing his holdings...

Between August of 2015 and April of 2018 Plantronics Inc. (PLT) director Brian Dexheimer sold $1.18 million of his company’s stock on the open market. Two days ago, he bought it all back.

On Feb. 5 the Santa Cruz-based headset maker reported earnings per share of $1.36, beating estimates by 68%. Revenue grew 122% year over year to $510.67 million.

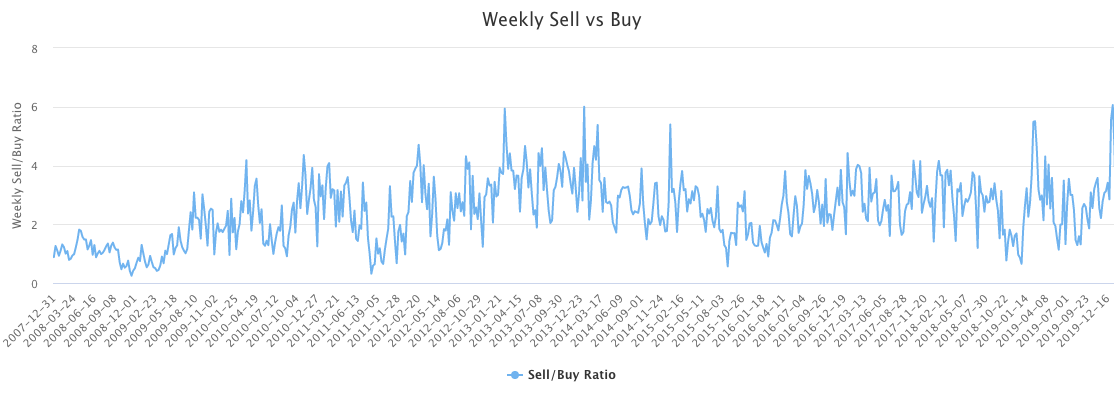

"Insiders are selling stock like it's 2007." That's a headline from August 27, 2019. Sounds ominous. One might have been inclined to think: The smart guys are dumping stock, guess I should too. Well that would have been a big mistake. Since that headline was posted, the...