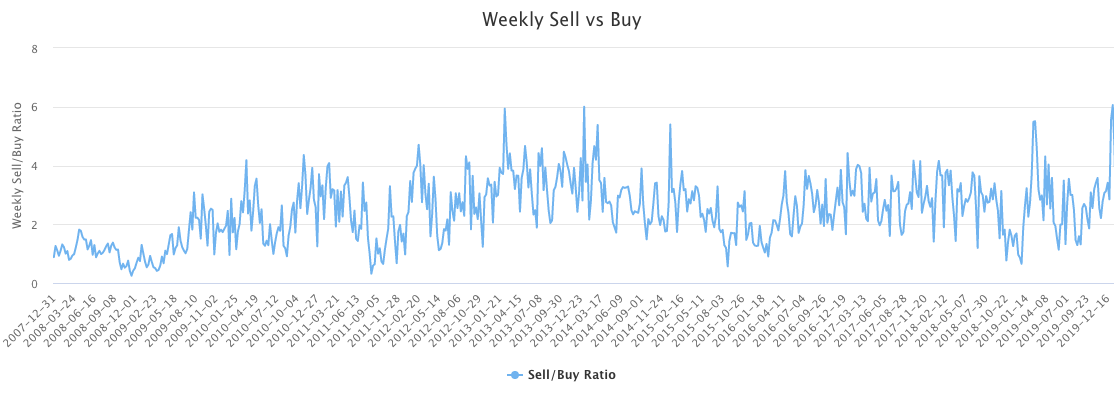

As we've previously written, when insiders as a group buy en masse, it has historically signaled that stocks were broadly undervalued and a market bottom was at hand. As of Friday's close, the WhaleWisdom Insider Sell vs Buy Ratio for the week of Feb. 24 was 1.42....

Tiger Global has been selling Sunrun shares as fellow "Tiger Cub" Coatue Management buys shares of the solar systems retailer. Sunrun Inc. (RUN) has been a huge winner for Tiger Global, surging 352% year-to-date. But since Oct. 1, the $41B hedge fun run by Chase Coleman has...

Donald Trump's insider buying history is short, but interesting, given the fact that the former corporate insider is now the 45th President of the United States.

It was Monday, Sept. 15, 2008 at 3:08 PM when Donald J. Trump filed a Form 4...

In a March 28 Form 4 filing, two Winnebago Industries Inc. insiders disclosed buying a total of 6,000 shares of the Recreational Vehicle maker at $29.35.

Michael Happe, President and CEO of Winnebago (WGO) since January of 2016, bought 3500 shares, increasing his holdings...

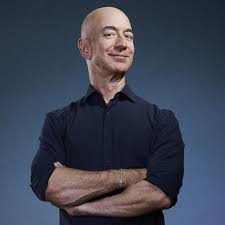

Jeff Bezos sold $3B of Amazon stock on Nov. 2 - Nov. 3. The world's richest person unloaded 1 million shares of his company at an average price of $3022.84. Amazon(AMZN) closed today at $3143.74, down 4.57%. The sales reduced the founder's stake in the giant online...

There’s an old Wall Street saying: “Don’t try to catch a falling knife.” Sage advice, but in recent weeks stocks have been falling like a thousand machetes. If you’re an investor, every buy decision made since October has likely had the same result – you’ve ended up bloodied.

However, there...

Paul S Levy, Chairman of the Board at Builders FirstSouce Inc. (Nasdaq:BLDR) significantly increased his stake in the building products manufacturer by 10%, buying 100,000 shares on Sept. 6 on the open market at $15.98. According to a Form 4 filed with the SEC on Sept. 7, Levy increased his stake to 1,117,984 shares or about 1% of BLDR’s shares outstanding.

"Insiders are selling stock like it's 2007." That's a headline from August 27, 2019. Sounds ominous. One might have been inclined to think: The smart guys are dumping stock, guess I should too. Well that would have been a big mistake. Since that headline was posted, the...

Nothing like putting a million bucks where your mouth is.

After a presentation yesterday at the JPMorgan healthcare conference yesterday, an analyst bad-mouthed medical device giant Medtronic Plc (MDT) and cut price targets. As the stock tumbled over 6%, Medtronic CEO Omar Ishrak went on television to defend his company and debunk critics.

Then today he bought $1 million dollars of MDT on the open market.

Newell Brands (NWL) stock tumbled 22% over three days, but a long-time lieutenant of activist investor Carl Icahn was buying, picking up $1 million worth on August 8 at $20.50. In total, 3 directors of NWL bought $1.7 million of stock into the downdraft. The purchases were disclosed in Form 4 filings submitted today.